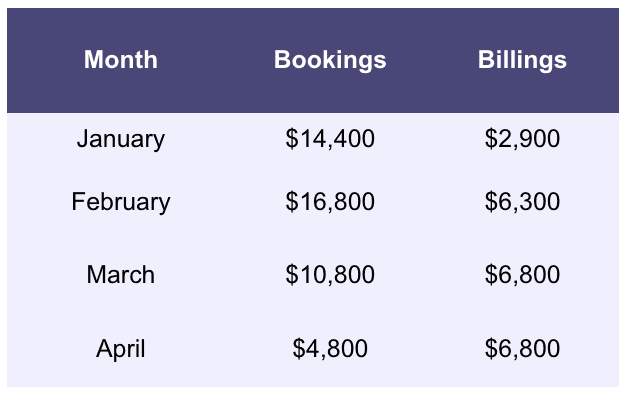

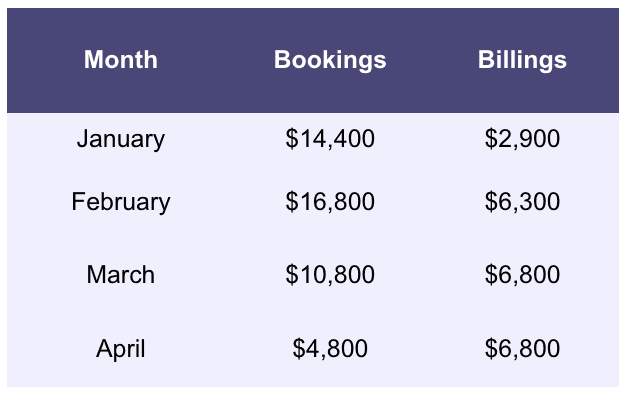

Recognize revenue when (or as) the performance obligation is satisfied. Identify the performance obligations in the contract. The 5-step process for revenue recognition under ASC 606 is: This model is aimed at directing businesses about how much and when to recognize revenue. This cleared up the clouds of confusion that loomed over SaaS accounting due to inconsistent and unclear practices. To overcome these shortcomings, FASB (which governs US GAAP) and IFRS joined hands to establish a new revenue recognition standard, called the ASC 606.ĪSC 606 has an overarching framework that covers all bases for SaaS revenue recognition. GAAP were considered to be conflicting in certain areas. Make it easy for investors and stakeholders to comprehend and compare the financial statements across companies and industries.ĪSC 606 Guidelines and What They Mean for SaaSĪccording to FASB which governs the US GAAP, revenue recognition requirements of IFRS lacked sufficient detail and the accounting requirements of U.S. Eliminate variations in the way businesses across industries handle accounting for similar transactions by bringing standardization and transparency in financial reporting across companies and industries. The alternative for most other countries is the International Financial Reporting Standards (IFRS), which is regulated by the International Accounting Standards Board (IASB). Revenue recognition is one of the principles of the Generally Accepted Accounting Principles (GAAP US), which is regulated by the Financial Accounting Standards Board (FASB). The rules and guidelines for financial accounting and reporting are enlisted by accounting standards. You can find a detailed example with calculations of bookings, billings, and revenue here. Revenue recognized for January are: $1000. This is according to US GAAP accounting standards, which state that revenue can only be recognized once it is “earned.”įor example, if a customer signed up for an annual plan of $12000 (billed monthly) in the month of January: So every month, you recognize revenue only for the service that has been delivered. Relying only on bookings and billings can lead to an inaccurate picture of the state of a business. Revenue is the actual income earned when you deliver on the promised service to your customers. If the billings are low while bookings remain healthy, there are chances of facing cash flow problems.įor more tips on cash flow, check out how our platform can help you aggregate and understand your financial data. Simply put, billings are when you actually collect money from your customer and it directly impacts the cash flow of a business. This can be over different time periods, like a monthly or an annual invoice. Bookings cannot be recognized as revenue until the service is rendered.īillings, on the other hand, are the invoices sent to your customers. Total bookings (including renewals and expansion) can help in tracking how much revenue can be recognized in the future, once the sales team converts the opportunity into a paying customer. For a particular month, your bookings comprise the sum of all deals closed in that month. #Difference between bookings and revenue how to#

Let’s first understand what these terms mean and how to calculate them.īookings are when your customer goes, ‘heck yes, I want to buy your product.’ It indicates the value of a contract signed with a prospective customer for a given period of time. What are Bookings, Billings, and Revenue in SaaS?īookings, billings, and revenue in SaaS are all closely related to each other. Here’s what every SaaS business needs to know about revenue recognition and compliance to standards like ASC 606. So, understanding the nuances of revenue recognition in SaaS is necessary, because you don’t want to give the wrong picture to your stakeholders and misreporting your recognized revenue can get you into unwanted tax compliance issues. Since these are important indicators of your growth, investors are going to keep a close eye on them as well. There are structured rules around how businesses should calculate and report revenue. Revenue recognition is the process of converting cash from ‘bookings’ into ‘revenue.’ So, it helps to understand a few key top-line metrics like bookings, billings, and revenue. Given its recurring revenue model, SaaS revenue recognition can be an accounting nightmare.

But the actual cash that hits your books is another story altogether. When you see all the sales bookings rolling in, it’s naturally exhilarating.

Updated: When you are scaling a fast-growing SaaS company, your first and foremost focus is - and rightly so - increasing your revenue.

0 kommentar(er)

0 kommentar(er)